You are here

Subscribe to the IPI in May and Receive 2 Free Months!

Phoenix, Arizona May 10, 2011 - Semico Research is forecasting 2011 semiconductor revenue will reach 8% growth this year. We'll head into a slowdown during the second half of 2011 going into 2012, causing some cutbacks and bringing 2012's total growth to 2%.

These numbers are backed by our Inflection Point Indicator (IPI) as well as current events in the semiconductor industry. As we discussed at the Summit, one example of a market that will experience cutbacks will be the tablet market.

Approximately 100 tablet models are being introduced in 2011, each with a market share goal of more than 1%. Some will win and some will lose, causing excess capacity and inventory in the channel as these models shakeout. For ASPs, the supply chain only has to be a few percent points out of equilibrium to cause prices to crash.

Another example is the smart phone market. The smart phone market is considered a "promised land" as it continues to grow at double-digit rates with increasing semiconductor content. As a result, it has a similar problem to the tablet market, where overbuilding of smart phones will result in a production pullback in 2012, contributing to excess capacity and inventory that will drop ASPs.

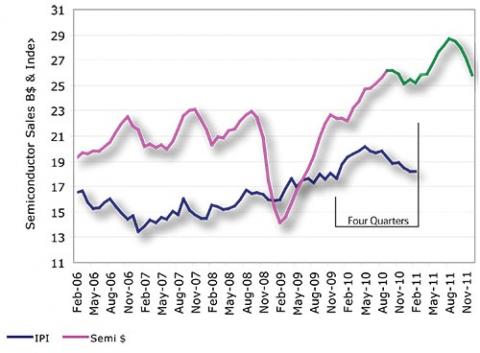

These are the types of market conditions the IPI discusses every month, backed not only by analysis of end-use markets, but up-to-date blue book numbers as well as the IPI chart below, an ASP chart, and four month-to-month inventory charts.

Source: Semico Research Corp.

Semico developed the IPI (Inflection Point Indicator) to assist in forecasting semiconductor revenues approximately four quarters in advance. The previous twelve months on the blue line is the forecast for the pink and green line. On the graph above, we are seeing the second half of 2011 as the beginning of the next market showdown.

The industry news supports what our Inflection Point Indicator (IPI) has been showing all year. For eight years the IPI has been an accurate forecasting tool to know far in advance whether the industry will swing up or down. If you'd like to subscribe to our IPI to stay ahead of the news in 2011, contact us at jfeldhan@semico.com or 602-997-0337.

About Semico

We are a semiconductor marketing & consulting research company located in Phoenix, Arizona. Semico was founded in 1994 by a group of semiconductor industry experts. We have improved the validity of semiconductor product forecasts via technology roadmaps in end-use markets. Semico offers custom consulting, portfolio packages, individual market research studies and premier industry conferences.

Add new comment