You are here

Trade Disputes Increase Market Uncertainty

The World Semiconductor Trade Statistics (WSTS) organization held its bi-annual forecast meeting in Scottsdale, Arizona last month, and one of the topics that seemed to be on everyone’s mind is the impact of tariffs and the trade tensions between the United States and China. The presentation with the most insightful information on this topic was provided by Falan Yinug, Director, Industry Statistics and Economic Policy, at the Semiconductor Industry Association (SIA).

The need to impose tariffs on U.S. imports of semiconductors is perplexing because as of 2017 the United States maintained a semiconductor trade surplus of $2.1 billion with China. In addition, most of the U.S. imports of semiconductors from China are products from U.S. semiconductor companies that are either designed and/or have undergone front-end fabrication outside of China.

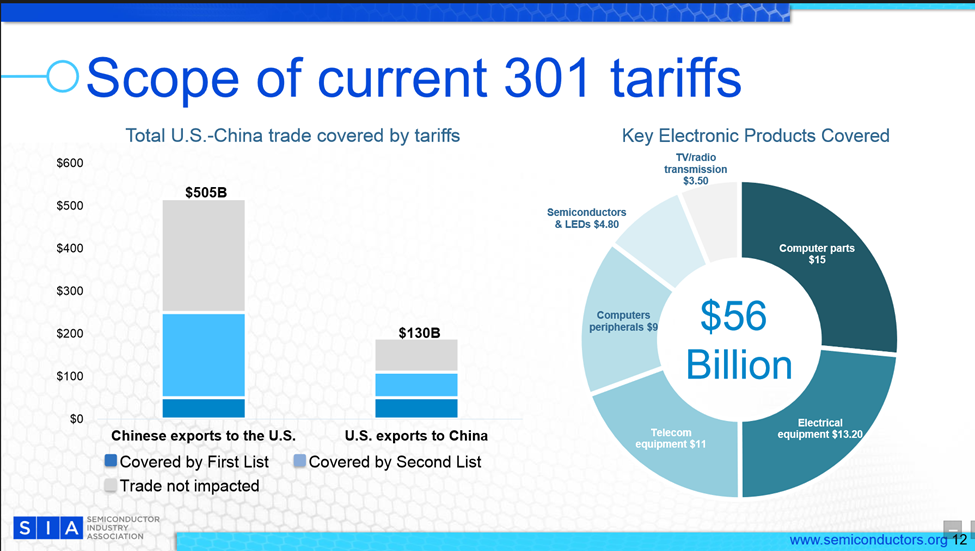

Trade disputes can quickly spin out of control, as shown in a timeline presented by Yinug. In 2017, the Office of the U.S. Trade Representative (USTR) initiated a Section 301 Investigation. By April 2018, USTR released a proposed $50 billion tariff list and China quickly retaliated with its own $50 billion tariff list. SIA submitted comments to USTR seeking removal of 28 products of importance to the U.S. semiconductor industry. By July 2018, tariffs on the $34 billion “List 1” went into effect along with China’s retaliatory tariffs. USTR then released a $200 billion “List 3” subject to 10% duty which included printed circuit assemblies. A 25% tariff on the remaining $16 billion worth of goods (List 2) went into effect in August. The 10% tariff on $200 billion China goods began on September 24th and was expected to be increased to 25% by the end of the year. Key electronic products covered by the tariffs currently amount to $56 billion, which include all U.S. imports of semiconductors from China.

Source: SIA

Although most of the speakers and attendees did not expect talks at the G20 Summit to alleviate the trade disputes or eliminate the new round of tariffs to be imposed in January 2019, there was some hope that the recent mid-term elections might have some positive effect. Several of the congressional districts that flipped from Republican to Democrat are districts that include heavy concentrations of semiconductor industry jobs. For example, Peter Sessions (R), Representative for the 32nd District of Texas was defeated by Colin Allred. Although health care was listed as the biggest issue for this District, Sessions was challenged for his inconsistencies regarding trade issues, specifically tariffs. District 32 includes approximately 15,000 semiconductor jobs, primarily those provided by Texas Instruments. In Virginia’s 10th congressional district Barbara Comstock (R) supports free trade but supported the Trump Administration tariffs, because they were a part of a strategy to get better deals for America. She was defeated by Jennifer Wexton (D). There are approximately 1,500 semiconductor jobs in this district, primarily provided by Micron Technology. Similar flips were noted in the San Diego and Irvine, California districts, as well as in Colorado’s 6th District.

Although there was no consensus by WSTS meeting attendees on the impact of these tariffs on the overall industry, Semico recognizes the increased level of uncertainty is already having an effect on company contingency plans. Partnerships, purchasing and inventory levels are all impacted by increased levels of uncertainty, and we already are seeing companies develop contingency planning scenarios.