You are here

Semico's IPI Points to Moderate 2006

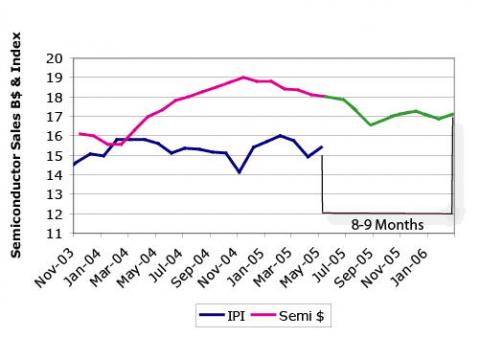

Semico IPI - Source: Semico Research Corp.

Phoenix, Arizona July 25, 2005 - Semico’s Inflection Point Indicator (IPI) registered 15.4 in May, up from a restated 14.9 in April. Semico’s IPI is designed to forecast the market 8 to 9 months in advance; the current IPI points to the January-February 2006 timeframe.

Prior results showed the IPI increasing in January and February, followed by declines in both March and April. The fluctuations in the IPI reflect various factors helping to balance the market, resulting in temperate conditions.

Inventory levels have improved, and are now only mildly out of kilter. We continue to experience pricing pressures, combined with low capacity utilization. However, end-use market strength is sustaining, preventing prices from collapsing.

This stability is reflected in Semico’s forecast of very moderate growth, with either single-digit growth or decline occurring in each of the remaining quarters this year, with no one quarter expected to fluctuate by more than two percentage points.

For the remainder of 2005, the state of the industry is best described as temperate. Historically, semiconductor growth generally falls within two categories—sub-10% growth, or years in which growth exceeds 18%. This year, indications are the market will experience sub-10% growth—Semico continues to forecast worldwide semiconductor revenue shipments will increase 2.0% in 2005 to $217.3 billion.

Looking ahead, the IPI shows early indications that 2006 will be another moderate year, with revenues increasing 8.1% to $234.9 billion. Similar to 2005, we do not expect large fluctuations in quarterly revenue growth in 2006. We will continue to closely monitor the IPI for signs that the market will experience more extreme quarterly variances in the forecast next year.

The recovery will experience stronger growth in 2007 and 2008, with each year projected to increase by more than 18%; 2007 revenues are expected to escalate 19.8%, followed by another relatively strong 18.1% growth in 2008.

Semico Research developed the Inflection Point Indicator to assist in forecasting semiconductor revenues approximately two quarters in advance. IPI—combined with our bill-of-materials, end-market analysis and primary research—has helped Semico Research accurately forecast the industry ahead of all the other prognosticators.

About Semico

Semico Research Corp is a marketing and consulting research company located in Phoenix, Arizona. Semico was founded in 1994 by a group of semiconductor industry experts. We have improved the validity of semiconductor product forecasts via technology roadmaps in end-use markets. Semico offers custom consulting, portfolio packages, individual market research studies and premier industry conferences.

Add new comment