You are here

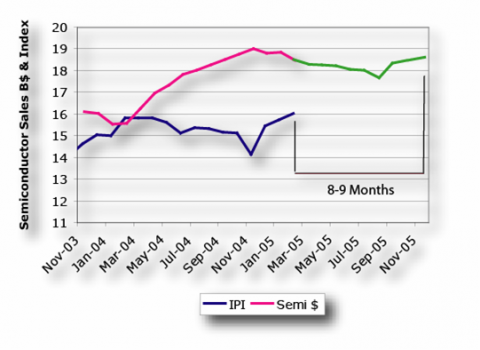

IPI Shows Upturn in Late 3Q05

Semico IPI - Source: Semico Research Corp.

Phoenix, Arizona April 13, 2005 - Semico’s Inflection Point Indicator (IPI) registered 16.0 in February, up from 15.7 in January. This marks the third consecutive month that the IPI has risen. Since the IPI is designed to forecast the semiconductor market 8 to 9 months in advance, this further substantiates Semico’s prediction of an upturn in the market occurring in the 3Q05 timeframe.

Notably, the Semico IPI indicates the upturn in 2005 will not follow historical trends, which is typically a bell-shaped curve in which a deep downturn is followed by a decisive upturn. Instead, Semico forecasts a moderate downturn occurring in the first two quarters of this year, followed by a similarly moderate upturn beginning in the third quarter.

This moderation in the current cycle is a result of continued end-use market growth and a better job of managing inventory levels. While end markets are exhibiting weakness, they are not declining. Both the PC and handset markets continue to grow, albeit at single digit rates. Inventory levels have been a definite factor in this year’s downturn; however, the imbalance has not been as excessive as in prior years.

On a quarterly basis, Semico’s IPI points to an elevated January. Coupled with the IPI’s prediction of a downward trend in February and March, this will moderate the first quarter, resulting in relatively flat revenues. Inventory levels for electronic computers, non-defense communications, and electronic components each rose from January to February. However, inventory levels for each of these categories fell from February to March, indicating inventories are slowly being reduced.

The trend in the second quarter will be very similar to 1Q05. Overall, the IPI indicates in 2Q05 the semiconductor industry will be weak, as the last of the excess inventories is burned off, and OEMs begin to place orders to refill the pipeline. Higher oil prices will spur concerns over inflation.

3Q05 marks the start of the recovery, as orders placed in the second quarter will begin to ship. As a result, capacity utilization will be on the rise.

Semico Research developed the Inflection Point Indicator to assist in forecasting semiconductor revenues approximately two quarters in advance. IPI combined with our bill-of-materials, end-market analysis and primary research has helped Semico Research accurately forecast the industry ahead of all the other prognosticators.

About Semico

Semico Research Corp is a marketing and consulting research company located in Phoenix, Arizona.

Semico was founded in 1994 by a group of semiconductor industry experts. We have improved the validity of semiconductor product forecasts via technology roadmaps in end-use markets.

Contact:

Jim Feldhan

Semico Research

T: 1 602 997 0337

jimf@semico.com

Add new comment