You are here

Will Higher Production Costs Hamper IoT Growth?

No question, 2017 is expected to be a good year for the semiconductor industry. Semiconductor revenues for 2017 are expected to increase over 9% this year. A 6% increase in unit sales, as well as higher average selling prices for memory products, will help drive the revenue growth rate to its highest level since 2010. Wafer demand is forecast to grow by almost 8%. The higher revenue growth compared to units and wafer demand is a welcome change compared to the last two years. But there are a couple clouds on the horizon.

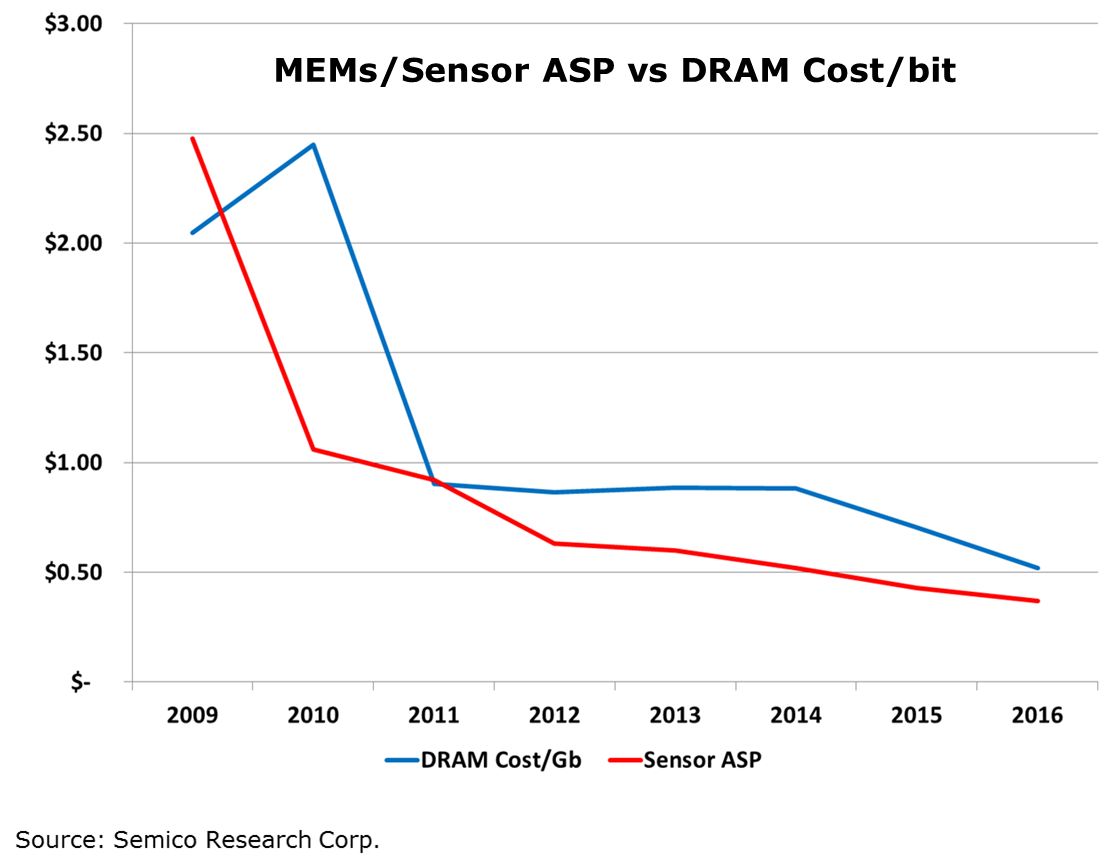

The strong unit growth over the past several years has been at the expense of falling average selling prices. New MEMS and sensor products, the driving forces behind IoT, have experienced steep declines in ASPs. The industry is very familiar with the declines in DRAM cost per bit and how that drives increased applications and demand for memory. Comparing MEMS and sensor ASP declines to that of DRAM, there is a close correlation between the two. In fact, between 2010 and 2016 sensor ASPs fell faster than DRAM cost per bit over the same timeframe.

Semico’s vision of the Internet of Things moves the industry from billions of devices to tens of billions of devices. The billions of electronic devices sold today have an average semiconductor content value of $85 per device. By 2030, there will be tens of billions of IoT devices sold, but the semiconductor content will only amount to approximately $10 per device. The proliferation of all these billions of electronics depends on the continued cost reduction of each semiconductor component.

Today, the threat of higher input costs could temporarily slow semiconductor ASP declines. We’ve seen memory prices increase over the past six months as memory manufacturers strategically manage capacity additions. There have been reports of increasing 300mm silicon substrate prices as silicon wafer manufacturers reach maximum capacity utilization in existing facilities. In addition, there continues to be concerns over the availability of 200mm used equipment, the key ingredient to inexpensive manufacturing for “More than Moore” products. If the cost of critical input materials such as silicon wafers and the cost of 200mm manufacturing capacity increases, how will the industry meet the demand for multiple billions of $10 electronic devices for IoT?