Major semiconductor foundries have revealed their advanced technology roadmaps for the next few years. They’re all investing billions of dollars into the development of process technologies and packaging options. The number of alternatives has been described as ‘dizzying’. How can all the foundries remain profitable? How does the customer decide which ‘route’ to take?

For the twenty-year period from the mid-1980s through the mid-2000s, process technology nodes were relatively easy to segment. Semico forecasted wafer demand into very clear process technology categories. Starting with the 45/40nm node in 2007, the two major logic manufacturers (Intel and TSMC) along with competing foundries began taking different paths. But the paths were still relatively clear. Intel rolled out their 45nm technology, and then TSMC rolled out their 40nm process. The foundries began to focus on low-power processes first. Then they followed up with their high-performance process several months to a quarter later.

Today, in addition to the number of different nodes, the challenge includes Intel’s claim that their 10nm process is comparable to the 7nm offered by other foundries. Semico believes the matching of product needs with process performance and cost will dictate market acceptance, not the marketing claims of technology-naming convention.

Interview with a Power Management Architect

by Richard Wawrzyniak: Principal Analyst; ASIC and SoC

Semico Research Corp.

Dynamic Power Management has become a 'must-have' in Systems-on-a-Chip (SoC) design today because of tightening power budgets and rising transistor counts. These increases mainly stem from evolving market requirements for more device functionality and richer feature sets being made available to meet changing market requirements. The semiconductor industry has responded with a plethora of different solutions to these issues.

Semico Research Corp. conducted an interview with Jawad Haj-Yihia, a Power Management Architect formerly of Intel Corp. in Israel.

The following article represents key aspects of that interview delving into many of the issues that confront Power Management Architects in the industry today.

Market Requirements Drive Power and Energy Targets

Today, there is a constant evolution in market requirements for silicon solutions targeted at mobile applications. This is primarily driven by user demands for more functionality while delivering greater ease-of-use to the end user. All these advanced features and increased functionality come at a price; greater power consumption and rising device complexity.

(Originally published at semiengineering.com)

If there is one truism in the semiconductor market, it is that rising costs will impact unit demand at some point if they continue long enough. The subject of this blog deals not with device ASPs; but rather with rising SoC design costs, and their effect on the number of designs at the advanced nodes. Even though the mechanism governing each set of numbers is different (device ASPs vs. design costs), the overall impact can be similar. In this case, the number of design starts is impacted by the climate of rising design costs.

Following are a few of Semico’s findings.

No question, 2017 is expected to be a good year for the semiconductor industry. Semiconductor revenues for 2017 are expected to increase over 9% this year. A 6% increase in unit sales, as well as higher average selling prices for memory products, will help drive the revenue growth rate to its highest level since 2010. Wafer demand is forecast to grow by almost 8%. The higher revenue growth compared to units and wafer demand is a welcome change compared to the last two years. But there are a couple clouds on the horizon.

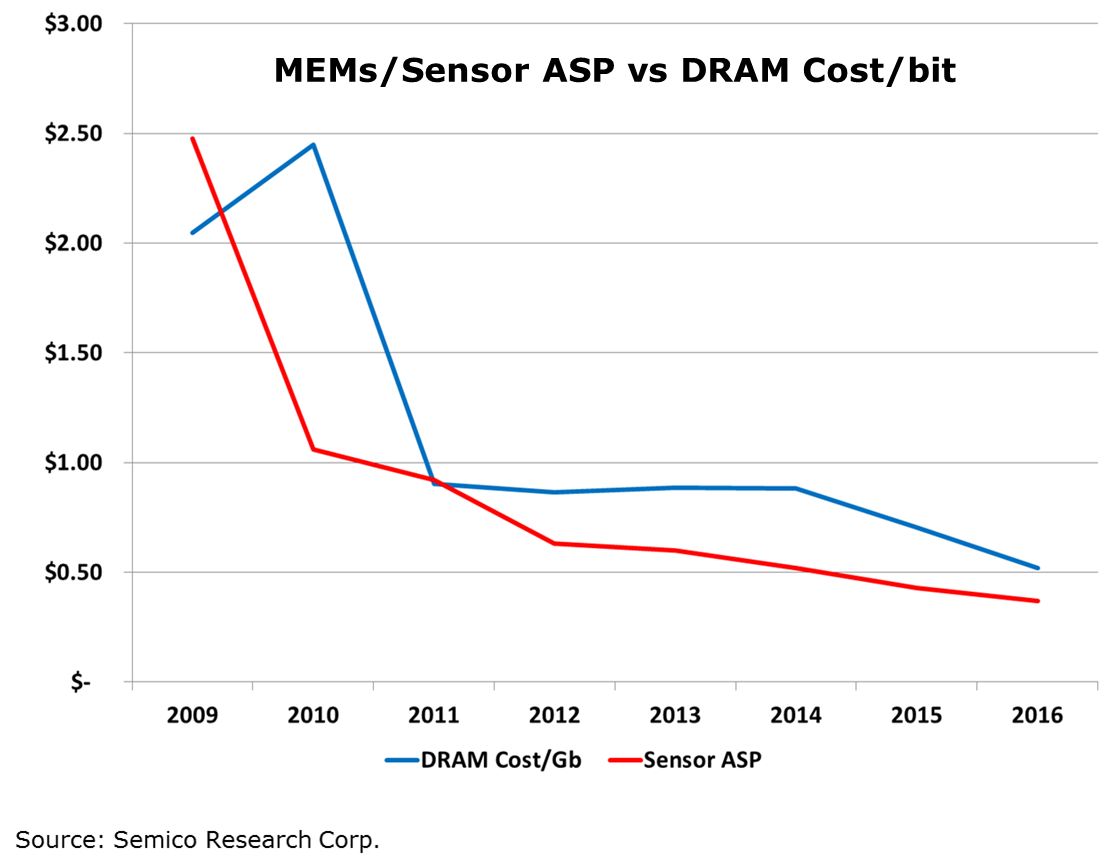

The strong unit growth over the past several years has been at the expense of falling average selling prices. New MEMS and sensor products, the driving forces behind IoT, have experienced steep declines in ASPs. The industry is very familiar with the declines in DRAM cost per bit and how that drives increased applications and demand for memory. Comparing MEMS and sensor ASP declines to that of DRAM, there is a close correlation between the two. In fact, between 2010 and 2016 sensor ASPs fell faster than DRAM cost per bit over the same timeframe.

Semico Research has just released a mature technology market research study. Wait! Mature technologies? Aren’t those fabs trailing-edge technology, old hat, passé? They may use older technology, but there’s a lot of action there now.

For many years, semiconductor manufacturing has tended to migrate from older fabs to newer fabs in a predictable manner. Leading-edge semiconductors such as processors and memory migrated to leading-edge fabs. ASICs and other integrated circuits migrated to the second-generation fabs just vacated by the leading-edge parts. Discretes and other trailing-edge devices migrated to the third-generation fabs. Older fabs were decommissioned. That pattern ended several generations ago. The reasons are complex. It involves economics, diverging memory and logic technologies, new applications which require low power, and market dynamics which include company consolidation.

published by TechInsights on Wed, 2017-01-11 23:07

What a show! Not sure if it’s the weekend attraction of Las Vegas, but CES managed to retain the crowds through Saturday. Most booths were bustling with curious attendees trying to get a better understanding of the new products and underlying technologies. Once again, the automotive section was quite busy with autonomous driving and electrification of vehicles front and center. While Level 5 autonomous driving is still several years away from reality, all manufacturers are equipping cars with some type of enhanced driving autonomy or assisted driving. In the Ford booth we saw the Ford Lincoln (pictured below) equipped as an autonomous driving car.

The first thing one might notice is that the radar, lidar, and other electronics are nicely incorporated into the body, unlike what you would see in the Google car. The current generation of autonomous driving electronics is quite bulky. It’s somewhat analogous to the mainframes from the ‘70s, when one computer required a large dedicated room. Clearly, miniaturization needs to happen on the automotive side as the picture below shows the trunk completely packed with electronics. It looks like we could barely fit one bag of groceries into the trunk.

As the world’s devices get smaller and lighter with increasing power requirements, we need batteries that can provide more power for more time. Modern lithium ion batteries are reaching incredible energy densities enabling devices and vehicles to be more efficient than ever before. All energy storage devices have some risk, however these high energy densities come with increased danger. The dangers of lithium ion batteries have garnered national media attention with the explosions of Samsung smartphones, “hoverboards”, e-cigarettes, and other consumer electronic devices. While manufacturing error contributes to battery failure, many cases of battery explosions are the result of insufficient battery management technology built into the device.

Previous generations of portable devices and vehicles have used nickel cadmium, nickel hydride, or lead acid batteries. These chemistries are inherently less volatile than lithium chemistry packs and do not require constant monitoring. Lithium battery packs are much more finicky, requiring protection from overcharge, over-discharge, temperature, and physical shock. While all batteries can be damaged by these factors, lithium ion batteries become volatile and will overheat, catch fire, and explode.

The MEMS and sensor market continues to be a hotbed for innovation, new opportunities and, as with most new frontiers, there are also some disparate views on market dynamics and strategies. All this was evident at the 2016 MSIG Executive Congress last week in Scottsdale, Arizona.

First, I’ll cover the pioneering and fun subjects. In addition to the Technology Showcase demos and member presentations there were a couple of “outside-the-box” topics such as 3D-printed cars. Co-create was the buzzword on Day 2 and was used by Local Motors General Manager, Philip Rayer, as he showed off several 3D-printed vehicle designs which reduce manufacturing time while integrating a totally digital process and open sourcing options such as an OS battery management system. The company is co-creating an autonomous, electric car with partners such as IBM Watson, Siemens, NXP and Meridian. Rayer challenged the audience to consolidate the MEMS and sensors into a simplified suite of assemblies and reduce the wiring necessary.

Figure: Local Motors Strati 3D-Printed Car

Source: Local Motors

Well, now we know all about the iPhone 7. Having watched the announcement this morning, I am left with more questions than I had beforehand, however. First and foremost, why does the iPhone 7/7 Plus not include iris recognition? We’ve seen this feature added to several Android phones over the past year and a half or so. I think it’s time for a premium phone like the iPhone to have this feature. It was great that Apple inspired widespread use of fingerprint authentication on smartphones, but it’s time to catch up with iris recognition. It is, after all, a more secure biometric method; if you’re interested in learning more about biometrics and sensors, Semico just released a report on the topic.

Semico Research was pleased to host the 3D printing TechXPOT at SEMICON West 2016, in conjunction with SEMI. We also hosted the inaugural 3D printing session at SEMICON West 2014. What is striking is how much the 3D printing industry has changed in those two years. In 2014, 3D printing was at the height of media attention; the major questions were when each home would have its own 3D printer. In 2016, the conversation is much more focused on certain industries where 3D printing shines—namely, healthcare, automotive, and aerospace. In 2014, we were just beginning to put plastics and metals in the same 3D printed object. In 2016, the focus is now on refining those materials for conductivity and reducing design time and costs for PCBs.

Pages